Present value of lump sum calculator

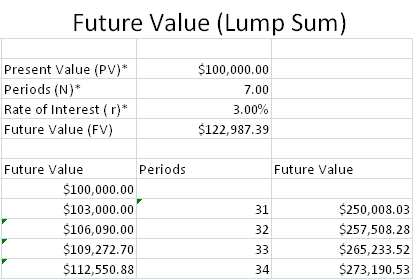

What is the formula for calculating the present value of an annuity. A lump sum calculator consists of a formula box where you enter the investment amount investment period in years and the annual rate of return expected on the investment.

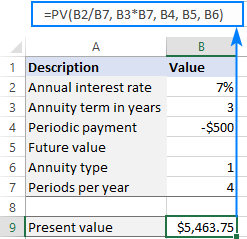

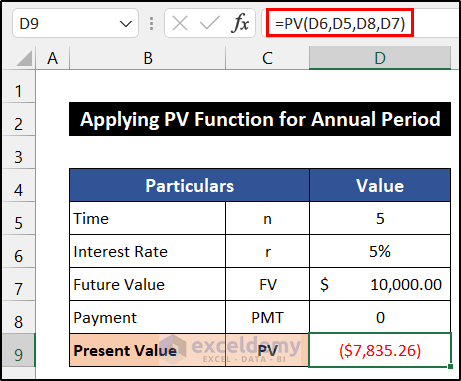

Using Pv Function In Excel To Calculate Present Value

Ultimate Retirement Calculator.

. To give an example there can be two situations first you are expecting a cash flow of 1k per month after 1 year for 6 months or you want to receive a lump sum of 55k now. A lump sum calculator is a utility tool that shows you the wealth gained over the long-term. As with many of our other calculators this calculator will also solve for an unknown input.

Enter the dollar amount as the future lump sum. Thus this present value of an annuity calculator calculates todays value of a future cash flow. If you want to adjust a single lump-sum without compounding try this inflation calculator.

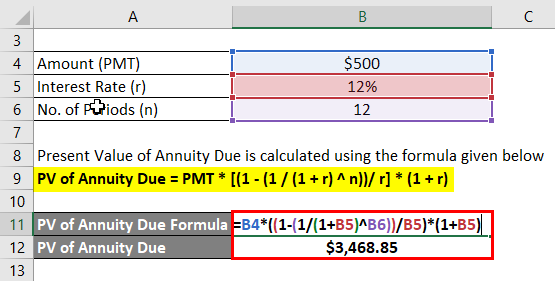

What is Present Value of Annuity Due Formula. The amount of money you have to invest now in order to reach your lump sum goal in time. The tutorial explains what the present value of annuity is and how to create a present value calculator in Excel.

PV formula examples for a single lump sum and a series of regular payments. Enter it as a percentage value ie. That means the party can take a single lump sum settlement of 36K today and have the.

Generally the option with a higher present value is the better deal. Present Value - PV. The present value of any future value lump sum and future cash flows payments.

The most important factor that has an impact on present value is interest or discount rate. For example if you want the calculator to calculate the regular monthly payment enter 0 zero for the Periodic Payment Amount and a non-zero value for Loan AmountCurrent Balance Number of Payments and Annual Interest Rate. The present value comes in useful too.

Related Retirement Calculators. The present value of an annuity is the value of a stream of payments discounted by the interest rate to account for the fact that payments are being made at various moments in the future. The present value of an annuity is the lump sum amount that would need to be invested today to receive a fixed series of payments in the future.

For example it can help you determine which is more profitable - to take a lump sum right now or receive an. In the context of pensions the former is sometimes called the commuted value which is the present value of a future series of cash flows required to fulfill a pension obligation. The annuity may be either an ordinary annuity or an annuity due see below.

To include an annuity use a comprehensive future value calculation. The future cash flows of. Present value PV is the current worth of a future sum of money or stream of cash flows given a specified rate of return.

Other helpful and related calculators include present value calculator and present value of an annuity calculator. Its called the ultimate retirement calculator because it does everything the others do and a whole lot more. Similar to bond or real estate valuations the value of a business can be expressed as the present value of expected future earnings.

PV C 1 1r n r 3. Present Value Formula and Calculator. An annuity can be defined as an insurance contract under which an insurance company and you enter into a contractual agreement whereby the user receives a lump sum amount upfront in lieu of series of payments to be made at the beginning of the month or the end of the month or at some point in.

Present Value of Money. 11 instead of 11. The present value of an annuity formula is.

Use this calculator to determine the value of your business today based on discounted future cash flows with consideration to excess compensation paid to owners level of risk and possible adjustments for. The present value of an annuity is the current value of a set of cash flows in the future given a specified rate of return or discount rate. Present value is linear in the amount of payments therefore the.

The present value is given in actuarial notation by. This calculator assumes monthly compounding so if you want a different time interval try this compound interest calculator. The purpose of this calculator is to provide calculations and details for bond valuation problems.

Present Value Of An Annuity. Cash Flows N Cash Flow PMT 6 Months Yield i. The present value will depend on the expected rate of return.

For instance if you have 50000 in your. It is a smart tool to calculate the return on a lump-sum mutual fund investment. The present value formula applies a discount to your future value amount deducting interest earned to find the present value in todays money.

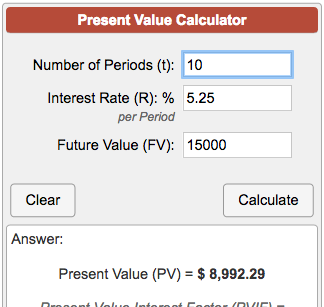

Present Value Discount Rate. The present value calculator computes the value when youre sure of the figure you want in the future or it computes backward when compared to the future value calculator. Calculate the future value return for a present value lump sum investment or a one time investment based on a constant interest rate per period and compounding.

Where is the number of terms and is the per period interest rate. Use the interest rate at which the present amount will grow. If you calculate youll see that the FV is 53928.

Annuity Payment Calculator helps you decide if receiving a lump sum of money is more beneficial than an annuity. The calculator discounts the annuity to a present value so that you can compare which option is the better deal. The user can determine the accurate value of the investment which can be done through SIP or lump-sum investment mode.

Most DB plans offer the option of a one-time lump sum payment or monthly benefit payouts. Explanations About 2022 calculator. When is the present value of annuity calculated.

Future cash flows are discounted at the discount. Fifth Third Banks Lump Sum vs. The PV is 36465.

The present value formula is PVFV1i n where you divide the future value FV by a factor of 1 i for each period between present and future dates.

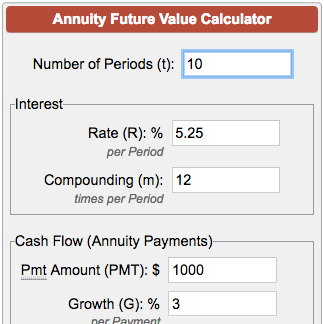

Future Value Of Annuity Calculator

Present Value Of A Lump Sum Youtube

Present Value Archives Page 2 Of 3 Double Entry Bookkeeping

Present Value Formula And Pv Calculator In Excel

Present Value Of Cash Flows Calculator

Present Value Formula And Pv Calculator In Excel

Present Value Of A Lump Sum In Excel Youtube

Future Value Of A Lump Sum

How To Calculate Present Value Of Lump Sum In Excel 3 Ways

Present Value Calculator Basic

Present Value Of Annuity Due Formula Calculator With Excel Template

Present Value Of A Lump Sum Calculator Double Entry Bookkeeping

Present Value Calculator

Calculating Present Value Accountingcoach

Present Value Of A Lump Sum Single Amount Financial Calculator Sharp El 738 Youtube

Present Value Of An Annuity How To Calculate Examples

Present Value Calculator To Calculate Pv Of A Future Lump Sum